What Ohio Accounting Students Can Learn About Ethics 20 Years After Enron

Shortly after being released from prison in December 2011, former Enron CFO Andy Fastow took to the speaking circuit with a presentation detailing the difference between rules and principles in accounting specifically and business more generally. Fastow argued that accountants and other business leaders can follow the rulebook and still fail to do the right thing.

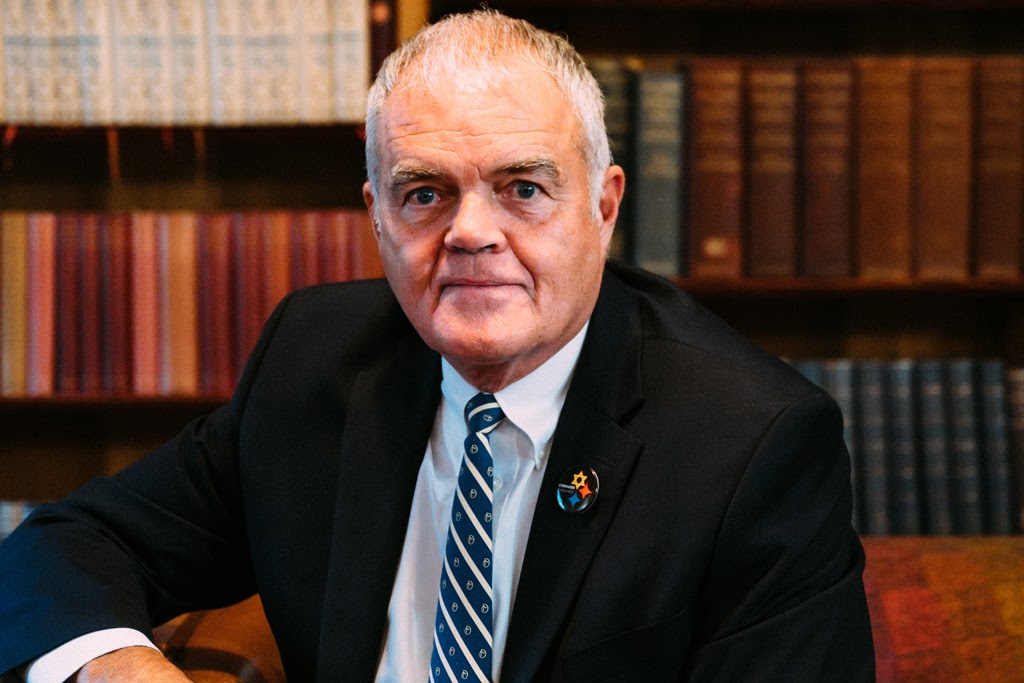

The remarks were being followed closely by someone standing just off stage that afternoon in Salt Lake City: Bill O’Rourke, former Alcoa executive, John Carroll University board member, accounting lecturer and author of “The Business Ethics Field Guide”

When his turn at the microphone came, O’Rourke gave the audience of accountants and Chief Financial Officers a far more direct imperative. “Act beyond the law,” said O’Rourke.

That’s straightforward advice for any student of an Ohio accounting program, at John Carroll University or elsewhere.

Ethics in Accounting

O’Rourke routinely lectures on Business Ethics to accounting and other business students at John Carroll University and across the country, drawing upon more than 40 years of corporate accounting and senior management experience. He also draws from a network that includes whistleblower, Sharon Watkins, who was the Controller at energy-giant-turned-cautionary-tale Enron; and Tyler Shultz, the whistleblower at Theranos, a fly-high-fall-hard startup that promised to revolutionize the blood testing industry.

“High-profile corporate falls from grace make for good copy,” O’Rourke says. “In my lectures I like to describe a few of these scandals, but I try to make the point that for every one of these scandals that get reported there are tens of thousands of executives who are working hard to try to act properly, to follow the rules and stay inside the lines. That proper behavior does not make the news, but maybe it should.”

The Impact of Enron 20 Years Later

We spoke to O’Rourke in early December, near the 20th anniversary of Enron’s bankruptcy, a case study now familiar to an entire generation of accounting program students and graduates. Enron emerged from a merger of two smaller energy suppliers (Houston Natural Gas and InterNorth) in 1985. The company shifted its business model in the 1990s and, momentarily, turned a sleepy natural gas pipeline company into a digitally-enabled energy trader, buying and selling gas and power. As robust digital tools emerged near the turn of the century, Enron created an electronic commodities trading platform — Enron Online (EOL) — gaining industry praise and the title “America’s Most Innovative Company” from Fortune magazine.

Such attention drove Enron’s stock price consistently higher, reaching its peak in August 2000. As some Enron executives began to sell their stock, allegedly on the basis of inside information regarding undisclosed losses, many Wall Street advisors pushed aggressive buy recommendations to individual and institutional investors.

Boler College of Business accounting professor Mark Sheldon offers this summary of Enron’s downfall. Senior management wanted to maintain the appearance of profitability, creating off-balance sheet companies to hide debt and inflate profits. The scheme worked as follows: Enron would transfer some of its rapidly rising stock to the off-balance-sheet special purpose vehicles (SPV) in exchange for cash or a note. The SPV would subsequently use the stock to hedge an asset listed on Enron’s balance sheet. In turn, Enron would guarantee the SPV’s value to reduce apparent counterparty risk. Enron showed $352m in profits in 2000 from the sale of assets to its own subsidiaries.

O’Rourke had a front row seat to the Enron scandal and its aftermath for corporate accountancy. “When the Enron fiasco happened, I was Alcoa’s Corporate Auditor,” he says. “I was very fortunate in my career with Alcoa to work for one of the world’s most enlightened corporate leaders (Paul O’Neill, Alcoa chairman and CEO, and United States Secretary of the Treasury during President George W. Bush’s first term.)

O’Neill drove O’Rourke and the accounting team to close the corporate books in three working days, years before the Enron collapse. “We had the fastest close and earliest release of earnings of any publicly traded company,” O’Rourke says. “O’Neill drove the three day close by installing common systems, having a common chart of accounts used by all 400 global locations in 63 countries. The close was fully auditable with no shortcuts (no early cut-offs, no estimates and no accruals). You can imagine the accounting and financial discipline we had at Alcoa.”

Sarbanes-Oxley Act: Legal Compliance vs. Ethics

O’Rourke describes the Enron scandal — and similar wrongdoing at WorldCom — as among the most consequential corporate governance and finance developments in history. The actions of Enron’s board and executives served as a primary motive for the passage of the Sarbanes-Oxley Act which created broad new accounting requirements.

The late Ohio U.S. representative Mike Oxley, an Ohio Republican and chairman of the Financial Services Committee, helped write the landmark 2001 anti-fraud legislation. The law reshaped corporate accounting oversight.

O’Rourke points out the Congress delayed Sarbanes-Oxley implementation for a year. Alcoa stood alone among major corporations advocating for immediate implementation. “Alcoa was already practicing all of the new guidelines before they were required,” he says. “The Enron disaster drove a lot of companies to do “more” but not Alcoa. Alcoa was already practicing strong accounting controls because its leader insisted on it.

O’Rourke offers a punctuating lesson: “Good leaders are driven by what’s right, not by legal compliance.”

Read More

Professor Mark Sheldon of the Boler College of Business, along with coauthors J. Gregory Jenkins and Velina Popova, explored the more recent impact of the Sarbanes-Oxley Act in their article “In Support of Public or Private Interests? An Examination of Sanctions Imposed Under the AICPA Code of Professional Conduct,” published in the Journal of Business Ethics

https://inspired-business.boler.jcu.edu/case-enron-and-fraud